On review, National Salary Packaging personally saved

me a significant amount of money on my novated lease. As a human resources manager, I want the best for my employees and know that they are in safe hands – NSP certainly delivers this in spades.

Kathy Lawson

Human Resources Manager, All About Living

A complete solution for Not For Profit organisations

No matter what size or capping threshold your organisation is, we have software, systems and benefits available to help run a successful employee financial wellness and engagement program. We provide:

- Complete in house administration and management services

- Same day benefit payment as payroll

- Beyond Bank Credit Cards for all the benefits

- We are FBT specialists, ensuring that all accounts are fully balanced, including HECS-HELP debts.

- NDIS Worker Screening Clearance Cards to hold in-house ‘lunch and learn’ sessions

- Access to all additional salary packaging benefits, including but not limited to: – Novated & Associate leases

National Salary Packaging not only look after every benefit available to you, we also work with you to provide solutions that will enhance your employee benefits program.

A Government and ATO driven incentive

The Australian taxation laws provide generous tax concessions for not for profit organisations within an FBT year (1 April to 31 March). You are able to pass on to your employees a proportion of their wages as reimbursement of personal expenses tax-free, depending on your FBT status.

This will determine if no income tax or FBT is payable in this money.

- Type in your ABN and scroll down to the charity tax concession status.

- You will see FBT Exempt or FBT Rebate.

Employees can salary package items up to $15,900 p.a. without paying any FBT or Pay As You Go (PAYG) Tax. This equates to up to $611.50 per fortnight.

Employees can salary package up to $15,900 p.a. without paying any PAYG tax, but there will be a percentage of FBT payable. If the FBT is a lower amount than your PAYG then there is a benefit to you.

*Disclaimer:

The information provided here does not offer a complete overview of applicable taxation methods. The examples shown do not use or consider any individuals own financial circumstances at all. All users must not rely on or consider any results generated as personal taxation advice. NSP is not licensed to provide taxation advice and recommend you seek independent financial advice. Salary packaging will adjust your salary amounts and may, in some instances, be unsuitable for some employees.

$18,550 tax-free benefits

- 1. $15,900 Everyday General Living Benefit

You can spend this tax-free money on everyday living expenses. For example:

- Mortgage

- Rent

- Credit card

- School fees

- Personal loans

- 2. $2,650 Meal, Entertainment & Holiday Benefit

You can spend this tax-free money on:

- Meals

- Entertainment, events, weddings, etc.

- Holidays

- Accommodation

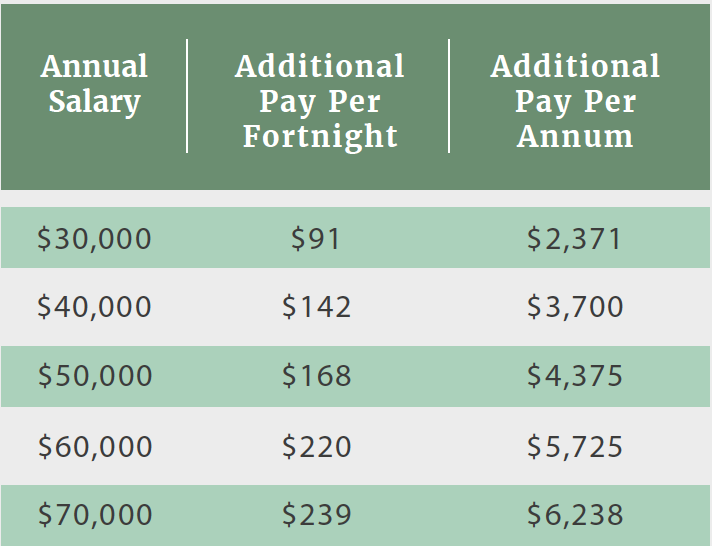

How much extra money can my employees take home by applying both these benefits?

Vehicle benefits that will save your employees thousands of dollars

As you know, vehicles can be a big expense and if not purchased, financed or insured correctly, can end up costing you a lot of money unnecessarily!

NSP are your go-to vehicle and finance specialists with over 30 years of experience helping people save time, money and effort. We’ll ensure the best-fit vehicle solution for your situation, so you can drive your vehicle for less.

Explore your vehicle finance scenarios and options to see if a novated lease or an asset car loan is the best solution for you to drive your car for less.

- Novated motor vehicle financed leases - Personal & Business use

- Associate leases - car at home tax benefits

- Discounted interest rates

- Discounted vehicle pricing - including advice, sourcing and finance solutions

- Free independent vehicle advice

- Need a vehicle for the short term? We have you covered

- Consumer car loans

EXAMPLE

- Wage: $70,000

- Laptop value: $2,000 (including GST)

- Salary sacrifice tax benefit: $800

- Plus GST input credit: $181.82

- Laptop cost: $1,018.18

- SAVING YOU: $981.82