Take home more pay working for Anglican Clergy

Welcome to National Salary Packaging

Please note the summary is ONLY for clergy with current salary sacrifice arrangements and we will be asking that all clergy request a consult with NSP. We will be sending through revised bank account details for the yellow highlighted accounts as these will need to be closed and reopened with the ACF.

In summary under our policy Religious practitioners may package amounts equivalent to:

- up to 30% of gross stipend, and

- up to 100% of motor vehicle or travel allowance (if applicable), and

- up to 100% of housing allowance (if applicable), and

- personal superannuation contributions.

Please scroll down to see what benefits are available to you. Our goal is to help you maximise every benefit so that you can build your unique portfolio and improve your financial wellness.

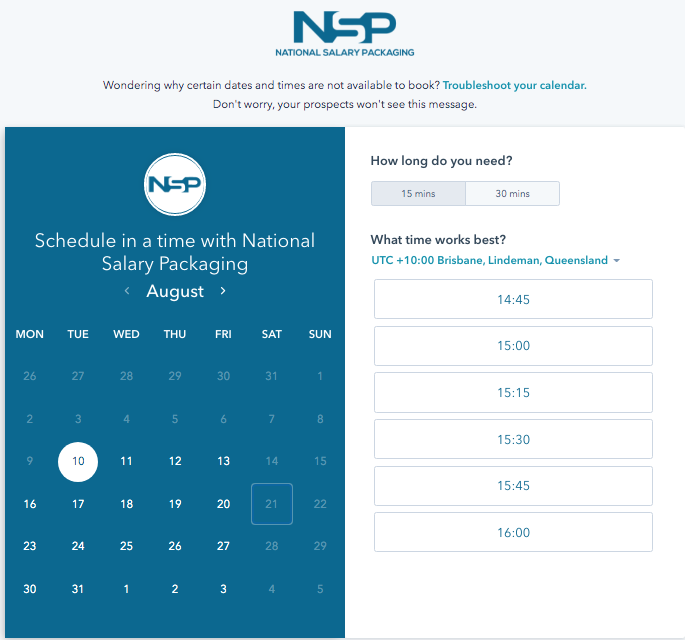

We highly recommend that you schedule your confidential free discovery session to find out how much additional income you will be taking home with these benefits.

Because everyone’s situation and income is different, we personally tailor a salary package solution for you to maximise the benefits available so you can take home more pay. All sessions are private and confidential.

Click on the link below to apply for your salary packaging benefits. We will set you up in the system, then be in touch to provide you with the login details for you to access your salary packaging account.

2. Vehicle benefits that will save you thousands of dollars

Vehicles can be a big expense, and if not purchased, financed or insured correctly, can end up costing you a lot of money unnecessarily!

We are your go-to vehicle and finance specialists, with over 30 years of experience helping people save time, money and effort, ensuring the best-fit vehicle solution for your situation so you drive can your vehicle for less.

Explore all the vehicle finance scenarios and options to see if a novated lease or an asset car loan is the best solution for you to drive your car for less.

- Novated lease - new vehicle tax benefits, plus GST-free running costs

- Associate lease - vehicle at home tax benefits

- Discounted finance interest rates

- Discounted vehicle pricing - including advice, sourcing and finance solutions

- Free independent vehicle advice

- Need a vehicle for the short term? We have you covered

FOR EXAMPLE

- Wage: $70,000

- Laptop Value: $2,000 (includes GST) will only cost you $1,018.18

- Salary Sacrifice Tax Benefit: $800

- Plus GST Input Credit: $181.82

- SAVING YOU: $981.82